Punjab Provincial Cooperative Bank Limited (PPCBL) 2024

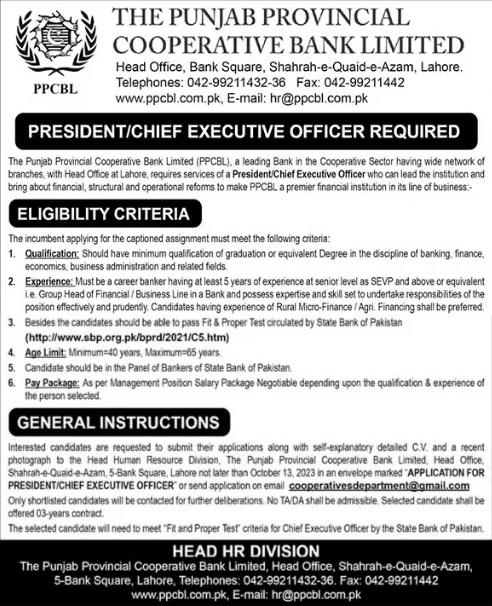

The Punjab Provincial Cooperative Bank Limited has announced the availability of this position. This PPCBL employment ad has been obtained from the Jang newspaper. PPCBL (Punjab Provincial Cooperative Bank Limited) is seeking Pakistanis who are dynamic, energetic, experienced, and educated. Candidates from the city of Lahore are eligible to register. Candidates are invited to apply for the position of President or Chief Executive Officer. Learn more about the procedure and how to apply it below.

Details Of Punjab Provincial Cooperative Bank Limited (PPCBL):

| Job Type | Full Time |

| Organization | Punjab Provincial Cooperative Bank Limited |

| Region | Punjab |

| Sector | Government |

| City | Lahore |

| Vacancies | 01+ |

| Salary Package | PKR, 80,000 – 150,000.est |

| Address: | Head, Human Resource Division, The Punjab Provincial Cooperative Bank Ltd., Head Office Shahrah-e-Quaid-e-Azam, 5-Bank Square, Lahore |

Vacant Positions:

- President / Chief Executive Officer

Eligibility Criteria:

| Gender Required: | Males & Females |

| Skills Required: | Administration, Management |

| Age limit: | Minimum age: 40 Years Maximum age: 65 Years |

| Education Required: | Graduation |

| Experience Required: | Minimum: 04 Years Maximum: 05 Years |

Salary Package

- Minimum Monthly Wage: 80,000 PKR (approximately).

- Maximum Monthly Wage: 150,000 PKR (approximately).

Benefits of Punjab Provincial Cooperative Bank Limited (PPCBL):

- Financial Inclusion: Typically, cooperative banks serve the financial requirements of rural and disadvantaged communities. PPCBL can facilitate the delivery of banking services to areas that may not have simple access to commercial banks, thereby promoting financial inclusion.

- Local Advancement: By providing financing and financial services to local businesses, farmers, and entrepreneurs, PPCBL can contribute significantly to the economic growth of the Punjab province. This can stimulate regional economic growth and create employment opportunities.

- Decreased Interest Rates: Typically, cooperative banks offer competitive interest rates on deposits and loans. Compared to other financial institutions, PPCBL members can benefit from lower financing costs and potentially higher savings returns.

- Member Possession: The participants in a cooperative bank own and control it. This means that the bank’s profits can be reinvested in the community or distributed as dividends to its members, rather than being distributed to outside shareholders.

- Community Assistance: PPCBL could actively support community development initiatives and programs. It can collaborate with local organizations and government agencies to resolve community needs such as education, healthcare, and infrastructure development.

- Services that are adaptable and tailor-made: Typically, cooperative banks take a more individualized approach to banking. Beneficial for small businesses and farmers in particular, they may be more willing to work with borrowers to tailor loan products to their particular requirements.

- Stability and Protection: The government regulates cooperative banks, which helps guarantee their stability and the security of deposits. Members can have confidence in the security of their savings.

- Moral Banking: Generally, cooperative banks are committed to ethical and socially responsible banking practices. They might prioritize lending to businesses and initiatives with a positive social or environmental impact.

- Education and Instruction: PPCBL may offer its members financial literacy programs and training. This can enable individuals and organizations to make informed financial decisions and enhance their financial well-being.

- Democratic Administration: Members of cooperative banks typically have a voice in the bank’s decision-making through democratic structures of governance. This provides members with a voice in the bank’s operations and services.

Check Also: Bank of Punjab Jobs 2024 – Apply Now

How to Apply for Punjab Provincial Cooperative Bank Limited (PPCBL)?

Interested candidates who complete the eligibility criteria then need to the follow below easy step-by-step process:

Step-by-Step Guide

Steps 1:

Collect all these documents.

- CV

- All Educational certificates

- Fresh Photographs (Passport Size)

- Experience Certificates

Steps 2:

Send the aforementioned materials along with the application to the following address.

- No TA/DA will be allowed for candidates.

- Applications that are incomplete or received after the specified deadline will not be considered.

PPCBL Jobs Advertisement

People Also Ask:

Is PPCBL a government or private company?

About us. Punjab Provincial Cooperative Bank Ltd. is a government- and people-centered enterprise controlled and run by its members to realize their common economic, social, and cultural needs and aspirations.

How many branches does PPCBL have?

The bank has an extensive network of 151 branches at the Tehsil and Sub-Tehsil levels. The PPCBL loan portfolio is extended to 100,000+ small farmers. We are the oldest financial institution in Pakistan.

What is the purpose of PPCBL?

The Punjab Provincial Cooperative Bank Ltd. was established in 1924 as an apex bank to meet the funding requirements of cooperative societies. It is engaged in all types of banking and credit business with societies and individuals. The PPCBL gained the status of a scheduled bank in 1955.

Rohma possesses a deep understanding of the education system and is well-versed in various academic disciplines. Her extensive experience allows her to provide invaluable guidance to students of all ages, from high school students exploring their interests to college graduates seeking career advancement.